Weighted Pools

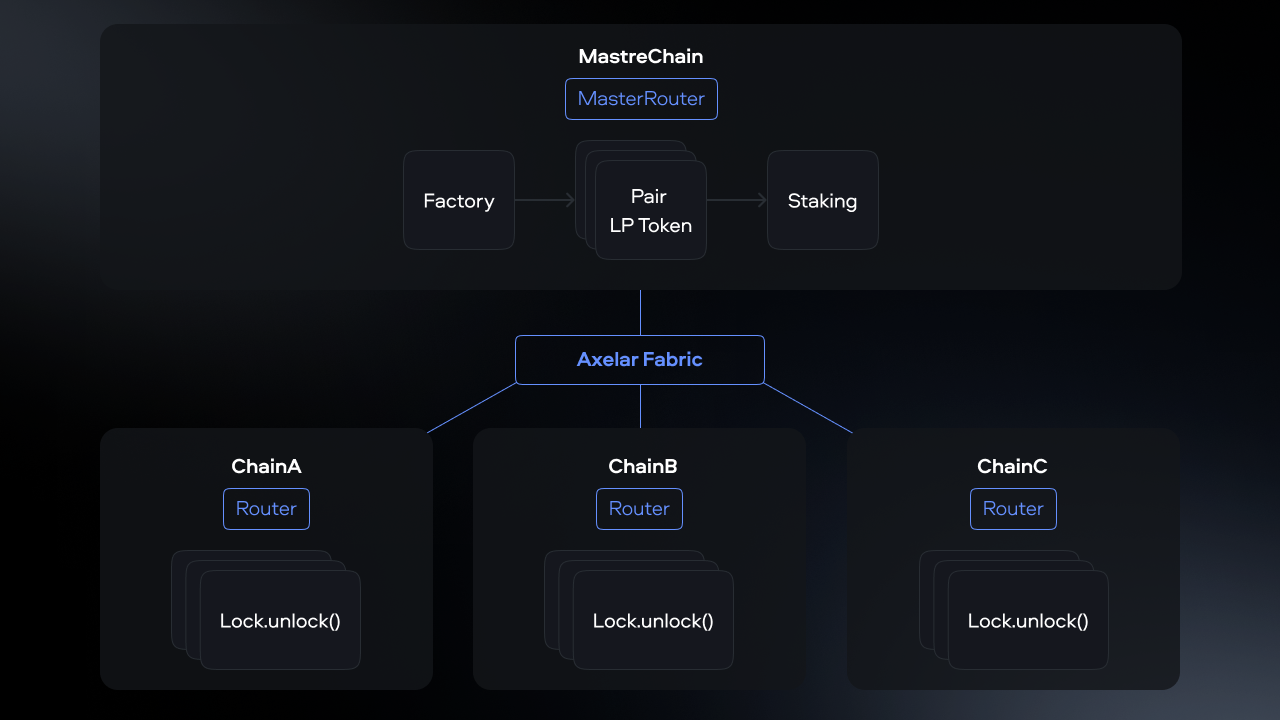

InterSwap Weighted Pools are different from traditional AMM liquidity pools. The InterSwapPair contract on the master chain does not store tokens; instead, it only maintains the state of the pool. Tokens themselves are securely stored in Lock Contracts on child chains.

InterSwap Infrastructure

InterSwap's AMM engine relies on simple yet robust mechanisms:

- Constant Product Market Maker for Weighted Pools (WeightedMath).

- Combination of Constant Sum and Constant Product for 1:1 correlated assets (StableMath).

Maximum Number of Assets

InterSwap has a dynamic limit on the maximum number of assets in a pool.

- Current limit: 8 assets

- Governance-adjustable: Up to a hard limit of 20 assets Initially, weights are equally divided when creating a pool. However, they dynamically adjust as users add or remove liquidity.

Read more about how pool weights work: Dynamic Weights.